Their goal is to maximize revenue while managing costs to ensure sustainable profits and contribute to the company’s long-term success. By contrast, profit centers are any business units that directly generate profit. These include the sales departments and subsidiaries, which are responsible for managing both their own costs and profits. A standalone product line could qualify as a profit center, as could a regional division of the larger company. Profit centers work under the supervision of managers who balance costs and revenues to drive profit. They’re responsible for all actions related to production and the sale of goods.

Profit Centre Meaning

They can invest capital in outside assets or companies to diversify the company’s risk. They’ll maintain their own financial statements including the income statement, cash flow statement, and balance sheet. Allocation of revenues and costs to profit centersis essential as it helps to identify relative profitability of differentrevenue generating divisions. This helps management in taking various decisionsrelated to income generating operations of the business. An alternative to the cost center approach is to treat a division as if it were like a business that had its own revenues and costs.

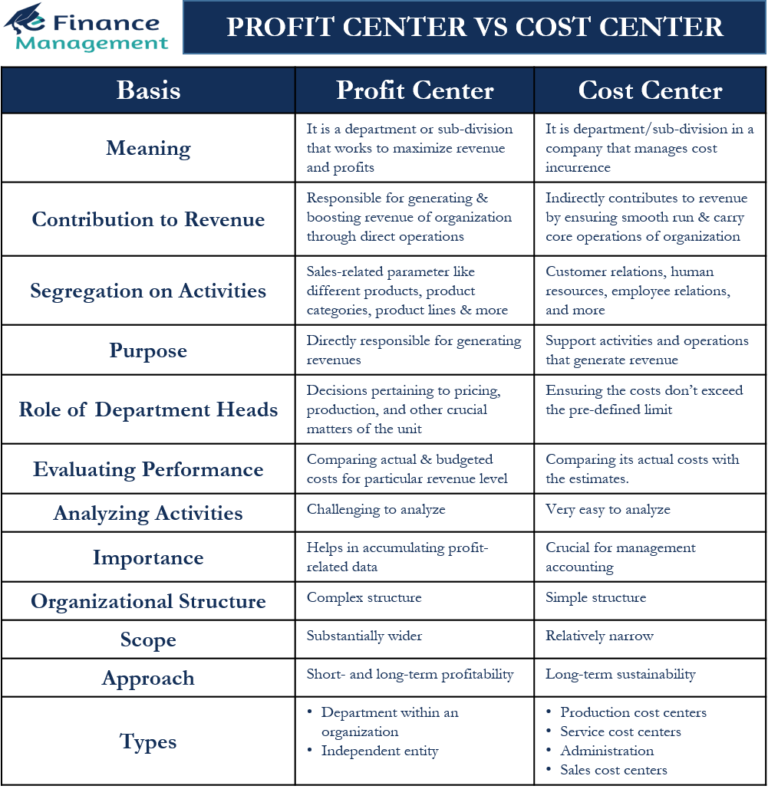

Differences Between Cost Center and Profit Center

After a few years, Peter Drucker corrected himself by saying that there are no profit centers in business, and that was his biggest mistake. He then said that there are only cost centers in a business and no profit center. If any profit center existed for a business, that would be a customer’s check that hadn’t been bounced. But without the assistance of the cost centers, the profit centers won’t function well.

Content: Cost Centre Vs Profit Centre

The principal object of a profit centre is to generate and maximise the profit by minimising the cost incurred and increasing sales. In multinational companies, the cost centre is authorised to decrease and manage the cost. These costs are generally monitored by analysing and deducting the actual cost incurred with the standard cost. Transfer price is nothing but the value placed on the exchange of goods and services between two profit centres. And the way in which we determine this profit, will decide the profitability of the supplying (selling) and receiving (buying) profit centre.

Frequently Asked Questions – The Key Differences Between Cost Centers and Profit Centers

- In a cost centre, it is pertinent to classify cost into fixed cost and variable cost.

- Moreover, cost centers are accountable for controlling and avoiding unnecessary expenditures, as their primary objective is to support the rest of the organization cost-effectively.

- They are evaluated based on their ability to generate revenue and profits, and their success is measured by KPIs such as revenue growth, gross margin, and net income.

- It can be done by using key performance indicators (KPIs) relevant to the specific functions of the cost center.

- Hence, the subdivision of the factory into a number of departments becomes essential.

They are often managed as separate entities within the organization, with their own profit and loss (P&L) statements. Organizations can gain insights into their overall performance by tracking performance metrics for cost and profit centers. It can help identify areas for improvement and ensure that the organization is moving toward its overall goals. Moreover, cost centers are accountable for controlling and avoiding unnecessary expenditures, as their primary objective is to support the rest of the organization cost-effectively. The key performance indicators (KPIs) for cost and profit centers differ significantly based on their primary objectives.

Cost Centers – Examples of Companies Operating as Cost Centers and Profit Centers

This can make it challenging for managers to evaluate the true performance and contribution of different parts of the organization, as spend doesn’t simply tell the entire story. A cost center is a unit of a business that isresponsible for incurring of costs. A cost center is generally that part of abusiness that does not directly generate square and xero revenue but supports the functioningof key revenue generating departments of a business. A cost center is termed as such as costs are incurred byit to keep it running. While these terms may sound familiar, it is essential to understand their key differences and how they impact the overall financial performance of a company.

It requires a clear understanding of the various types of business units within an organization, such as cost and profit centers. The managers or executives in charge of profit centers have decision-making authority related to product pricing and operating expenses. These departments are essential to the overall operations of a company, but they don’t directly generate profit.

This type of cost center would most likely be overseen by a project management team with a dedicated budget and timeline. A more specific type of impersonal cost center may define a geographical location for a cost center. A company may decide it wants to include or exclude the cost of employees for a certain region.

It is acknowledged upfront that a cost center will be unprofitable; however, a manager can still be held accountable to the degree at which they operate at a loss. On the other hand, an impersonal/machinery cost center isolates the costs of all non-employee costs. A company may be interested in only viewing the upfront cost, maintenance expenses, repair requirements, and other costs related to just the heavy machinery for a process. This type of cost center may coincide with other types of cost centers, as companies may want to know the non-personnel cost of a specific department, for example. Example – in a manufacturing concern, the productionand sales department of different product lines are profit centers.

It allows profit centers to focus on maximizing revenue and profits while balancing the need to control costs and maintain operational efficiency. They provide insights into the financial performance of specific business units, enabling management to identify profitable areas and allocate resources accordingly. By analyzing profit center data, organizations can make informed decisions regarding product pricing, marketing strategies, and investment opportunities.

Set revenue targets for profit centers to ensure they align with the organization’s overall financial goals. Regularly monitor the performance of cost centers to ensure that they meet their goals and targets. It can be done by using key performance indicators (KPIs) relevant to the specific functions of the cost center.