These elements can far exceed the value of tangible assets, particularly in tech or creative industries. In such cases, other valuation techniques such as discounted cash flow or multiples of earnings may serve as a better indicator of value. However, in combination with these other methods, the book value per share is still a powerful tool, playing a vital role in the evaluation of potential M&A deals. For example, let’s say that ABC Corporation has total equity of $1,000,000 and 1,000,000 shares outstanding.

Disregard for Intangible Assets

It’s a measure of how much each share would be worth if the company were to be liquidated and the proceeds distributed among shareholders. Value investors look for relatively low book values (using metrics like P/B ratio or BVPS) but otherwise strong fundamentals in their quest to find undervalued companies. If the market price for a share is higher than the BVPS, then the stock may be seen as overvalued.

How to Find BVPS?

You also need to make sure that you have a clear understanding of the risks involved with any potential investment. By multiplying the diluted share count of 1.4bn by the corresponding share price for the year, we can calculate the market capitalization for each year. We’ll assume the trading price in Year 0 was $20.00, and in Year 2, the market share price increases to $26.00, which is a 30.0% year-over-year increase. The book value of equity (BVE) is the value of a company’s assets, as if all its assets were hypothetically liquidated to pay off its liabilities. For instance, a company involved in manufacturing could invest in clean technologies to reduce their carbon footprint or divert a portion of its resources towards programs benefiting local communities. However, these investments not only mend the potential environmental and social effects of corporate practices but can also lead to more sustainable growth trajectories.

How Book Value per Share Differs from Market Value per Share

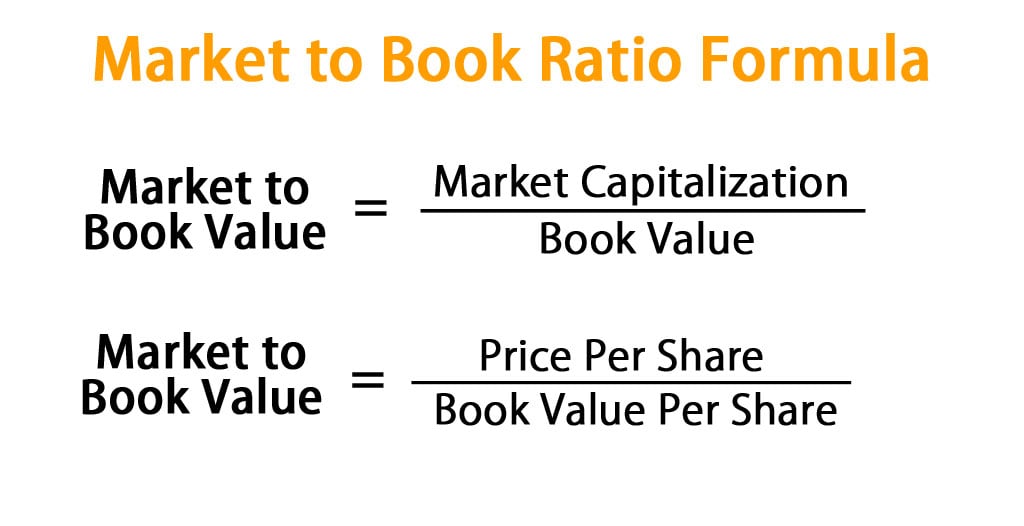

The market value per share is a company’s current stock price, and it reflects a value that market participants are willing to pay for its common share. The book value per share is calculated using historical costs, but the market value per share is a forward-looking metric that takes into account a company’s earning power in the future. With increases in a company’s estimated profitability, expected growth, and safety of its business, the market value per share grows higher. Significant differences between the book value per share and the market value per share arise due to the ways in which accounting principles classify certain transactions. Book value per common share (or, simply book value per share – BVPS) is a method to calculate the per-share book value of a company based on common shareholders’ equity in the company.

The book value meaning in share market, more commonly known as net book value or carrying value, is a financial metric that represents the value of an asset on a company’s balance sheet. In other words, it is calculated by taking the original cost of the asset and subtracting the accumulated depreciation or amortization up to the current date. Consequently, it can be conceptualized as the net asset value(NAV) of a company, obtained by subtracting its intangible assets and liabilities from the total assets.

But be sure to remember that the book value per share is not the only metric that you should consider when making an investment decision. BVPS is typically calculated and published periodically, such as quarterly or annually. This infrequency means that BVPS may not always reflect the most up-to-date value of a company’s assets and liabilities. Despite the increase in free file your income tax return share price (and market capitalization), the book value of equity per share (BVPS) remained unchanged in Year 1 and 2. Often called shareholders equity, the “book value of equity” is an accrual accounting-based metric prepared for bookkeeping purposes and recorded on the balance sheet. Whereas, a face value is the nominal value of a security, such as a share of stock.

- Because book value per share only considers the book value, it fails to incorporate other intangible factors that may increase the market value of a company’s shares, even upon liquidation.

- Investors often use book value per share to assess the company’s financial stability and make informed investment decisions.

- The ratio may not serve as a valid valuation basis when comparing companies from different sectors and industries because companies in other industries may record their assets differently.

- Book value per share relates to shareholders’ equity divided by the number of common shares.

- Interpreting the book value per share can provide valuable insights into a company’s financial health.

While corporate raiders or activist investors holding significant stakes can expedite this recognition, investors shouldn’t always rely on external influences. Consequently, solely relying on the book value of a company as a buying criterion may, surprisingly, lead to losses, even if your assessment of the company’s true value is accurate. “Cashing in on book value” is a strategy where an investor or a company takes advantage of the difference between the book value of an asset and its market value.

Investors can compare BVPS to a stock’s market price to get an idea of whether that stock is overvalued or undervalued. It approximates the total value shareholders would receive if the company were liquidated. If a company’s BVPS is higher than its market value per share (the current stock price), the stock may be considered undervalued. This situation suggests a potential buying opportunity, as the market may be undervaluing the company’s actual worth. However, the market value per share—a forward-looking metric—accounts for a company’s future earning power.

Book value refers to a firm’s net asset value (NAV) or its total assets minus its total liabilities. As previously stated, it represents the contrast between a company’s total assets and liabilities, as recorded on its balance sheet. Assets encompass both current and fixed assets, while liabilities comprise both current liabilities and non-current liabilities. A high book value per share often indicates that a company has more tangible assets relative to its outstanding shares. This could suggest the company has robust financial health because it owns valuable assets such as property, equipment, or other resources. Because book value per share only considers the book value, it fails to incorporate other intangible factors that may increase the market value of a company’s shares, even upon liquidation.

While the effect of such practices on book value per share may not be immediate, they form an integral part of the company’s long-term value creation strategy. Understanding and using the book value per share in these ways can aid investors in forming a solid and effective investment strategy. Remember, even if a company has a high book value per share, there’s no guarantee that it will be a successful investment. Investors use BVPS to gauge whether a stock is trading below or above its intrinsic value.